Best Travel Credit Cards: Maximizing the Benefits

How to Choose the Best Credit Card for Your Family | A Comparison of the Top Cards for Frequent Flyers

Hey there, fellow globetrotters! If you're anything like me, you live for that feeling of stepping off a plane and exploring someplace new. But let's face it, traveling can get expensive, especially with kids, which is why having the right credit card can make all the difference. Today, we're going to compare the best credit cards for frequent travelers. So buckle up and let's get started!

This article contains affiliate links to products I feel good about endorsing, meaning I may earn commission from qualifying purchases. Check disclaimers for more info.

Chase Sapphire Reserve

June 2025 Update: Big news, fellow travelers — Chase has announced some major changes to the Chase Sapphire Reserve. Starting in October 2025, the annual fee will jump a whopping 45% to $795 per year. Ouch.

🎉 What’s Still Great

- Big new sign-up bonus — You can now earn 125,000 bonus points after spending $6,000 in the first 3 months.

- New earning structure — For travel booked through the Chase Ultimate Rewards portal: 8× points on travel; direct bookings with airlines/hotels earn 4× points; dining still earns 3×.

- Travel + lifestyle credits and perks — The card keeps its $300 annual travel credit, plus continuing lounge access (Priority Pass, select Chase lounges), travel protections, no foreign transaction fees, and partner benefits (e.g., rideshare, food delivery) for many users.

- Points Boost option — For select flights and hotels booked through Chase Travel, there’s a “Points Boost” redemption option that can make your points worth up to 2×.

- Grandfathering window — If you applied before June 23, 2025 (or opened before the new changes), old redemption rules may still apply to points earned before a cutoff date — which might let you squeeze more value if you time things right.

⚠️ What’s Lost, Changed — and What to Watch Out For

- Less predictable redemption value — The previous “1.5× value on travel redemptions” is gone for many bookings. Now, unless a trip qualifies for Points Boost, points only redeem at 1.0× through the travel portal. That could reduce the effective value of your points substantially for ordinary bookings.

- More complexity / activation needed — Some of the new perks (credits, Points Boost, elite statuses, special hotel portals) may require activation or careful booking to unlock full value — meaning you’ll need to pay more attention to how and when you spend.

- Higher break-even threshold — To justify the new fee and realize the full benefit of the card, you likely need to travel frequently, book through Chase’s travel platform or partners, and maximize credits and perks. Otherwise, you may not get net positive value.

Pro-tips for maximizing your rewards

- Book airfare and hotels through the Chase Ultimate Rewards portal for 8x points. Don't forget to use this hack to get refunds or airfare credit if the prices drop!

- Earn 4x points on direct airline and hotel bookings (up from 3x)

- Redeem points at 2x for premium airfare and hotels with Point Boost

- Get credits back for dining at Chase Sapphire Reserve Exclusive Tables restaurants (up to $150 credit every 6 months)

- Get credits back for staying at The Edit collection hotels (up to $500 annual credit)

- Download the Priority Pass app and check for participating lounges wherever you fly. Don't underestimate the power of free alcohol and snacks to offset a long layover or travel delays. Plus, the newer Chase Sapphire Lounge (looking at you, LaGuardia Airport!) are not to be missed. Unlike Amex and Capital One, you can even bring a guest!

- Skip the long lines at security and get up to $100 statement credit every 4 years for Global Entry or TSA PreCheck® or NEXUS Application fees.

- Opt-in to credits. Currently Apple TV, DoorDash, Lyft, and Peloton users can all experience extra benefits.

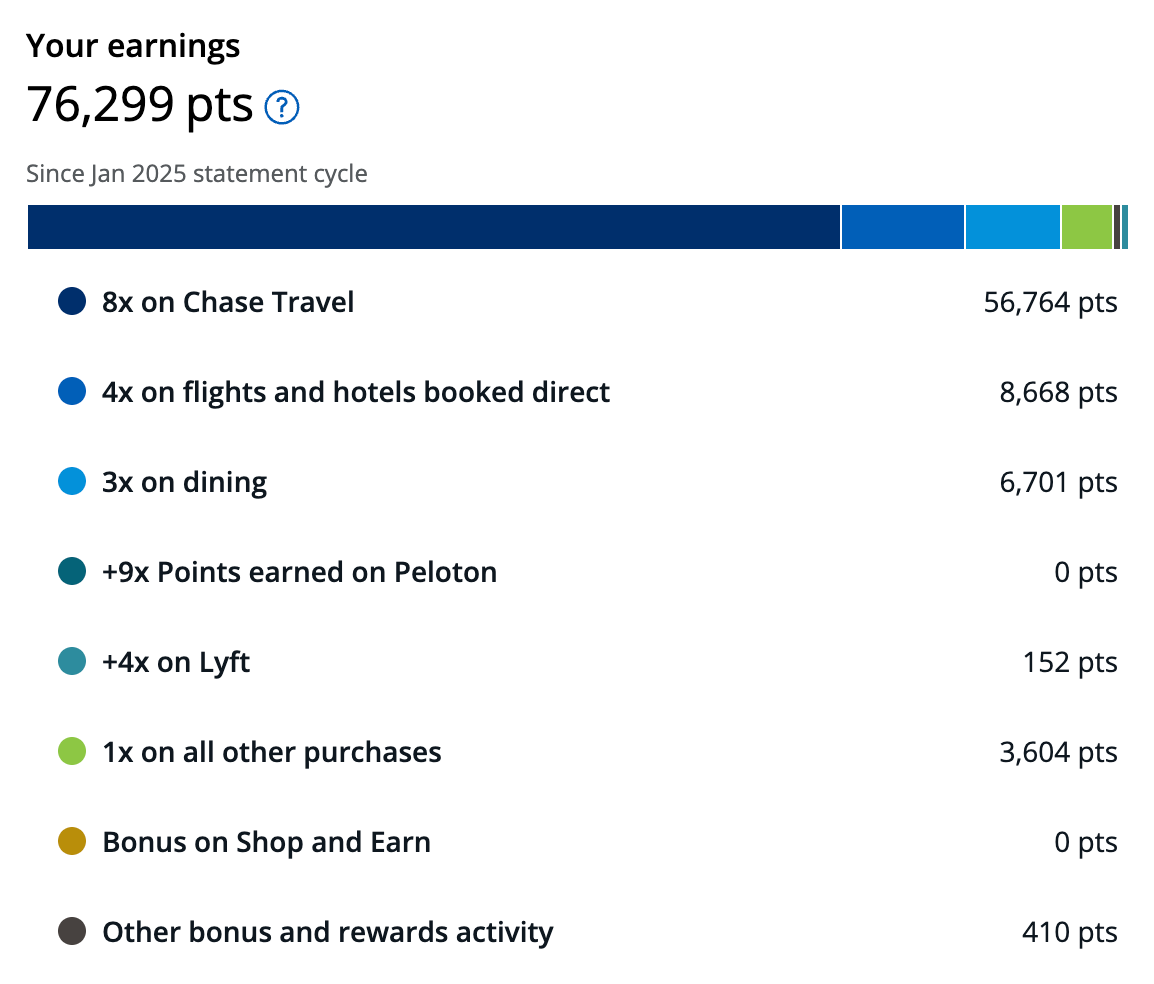

Using the tips above, we will be able to offset the hefty annual fee every year. You can see from our current earnings breakdown that since the changeover at the end of October, we have already earned enough to give us $750 cash back, but will be worth more when redeemed for travel at points boost hotels.

Benefits for Added Peace of Mind

When we book our trips with our Chase travel cards we never have to purchase additional travel insurance. When our flights back to New York were cancelled due to hurricanes, we had no trouble getting reimbursed for the extended hotel stay and expenses thanks to Trip Cancellation/Trip Interruption protection. This year when our rental minivan got scraped exiting the parking garage we were also protected by the Auto Rental Collision and Damage waiver. These are perks you hope to never have to use, but are grateful to have when bad things happen!

🎯 What This Means for Travelers

- If you travel regularly (flights + hotels), enjoy lounge access, and are willing to use the travel portal or take advantage of “Points Boost” + credits — the new Sapphire Reserve can still make sense, especially with the 125,000-point welcome bonus.

- If you prefer flexibility in how you redeem points, book travel outside of the portal, or travel less often — the higher fee and lower baseline redemption value may make it less appealing.

- For families (like yours!), it might be worth running the numbers: if you travel a few times a year, plus want lounge access and travel protection, it could justify the card — but only if you maximize benefits.

Capital One Venture X

This may be our new travel sidekick: the Capital One Venture X card — seriously high on perks, but worth every penny if you’re on the move. You’ll earn a generous 75,000‑mile signup bonus after spending $4,000 in the first 3 months (that’s a cool $750 in travel value). Then enjoy 10,000 bonus miles each year after your anniversary — that’s another $100 back annually. It comes with a $300 travel credit usable on Capital One Travel bookings every year and a $120 statement credit for TSA PreCheck or Global Entry every 4 years — perfect for breezing through airports. The annual fee is $395, but the credits, lounge access—including Priority Pass and Capital One Lounges—and elevated mile-earning (10X on hotels/rentals, 5X on flights via Capital One Travel, 2X on everything else) easily help you offset it. Perfect for travelers who want perks without needing to jump through extra hoops.

American Express Platinum Card

Best Sign-On Bonus: Next on the list is the American Express Platinum Card. This card has a $695 annual fee, but it currently offers up to a 175,000-point sign-up bonus (that's about $1750 in value). It also offers 5X points on flights booked directly with airlines or through American Express Travel. The Platinum Card also comes with a $200 airline fee credit and access to the Amex Global Lounge Collection. If you don't mind a bit of extra legwork, you can unlock prepaid hotel reservation credits, as well as credits for services such as Uber, Walmart, Disney+ and Hulu.

Citi Premier

Best value: Last but not least, we have the Citi Premier Card. This card has a $95 annual fee, but it offers a 60,000-point sign-up bonus and 3X points on travel, gas, groceries, dining, and entertainment or 10X points on purchases made through their CitiTravel portal. The $100 annual hotel reimbursement offsets the annual fee right off the bat and gives it a slight edge over Chase Sapphire Preferred which only offers a $50 hotel credit. It's best for travelers who want to earn higher rewards on everyday purchases without paying a premium annual fee.

So, there you have it, folks, the best credit cards for frequent travelers. Each card has its own unique benefits and is best suited for different types of travelers. Whether you value luxury, rewards, or a low annual fee, there's a credit card out there for you. Happy travels!

Comments ()